It’s often said that we live in a changing world, a world where awareness of human rights, the environment and equality are growing exponentially. It would be naïve to expect – or perhaps even permit – business and commerce to act in isolation from this new mindset.

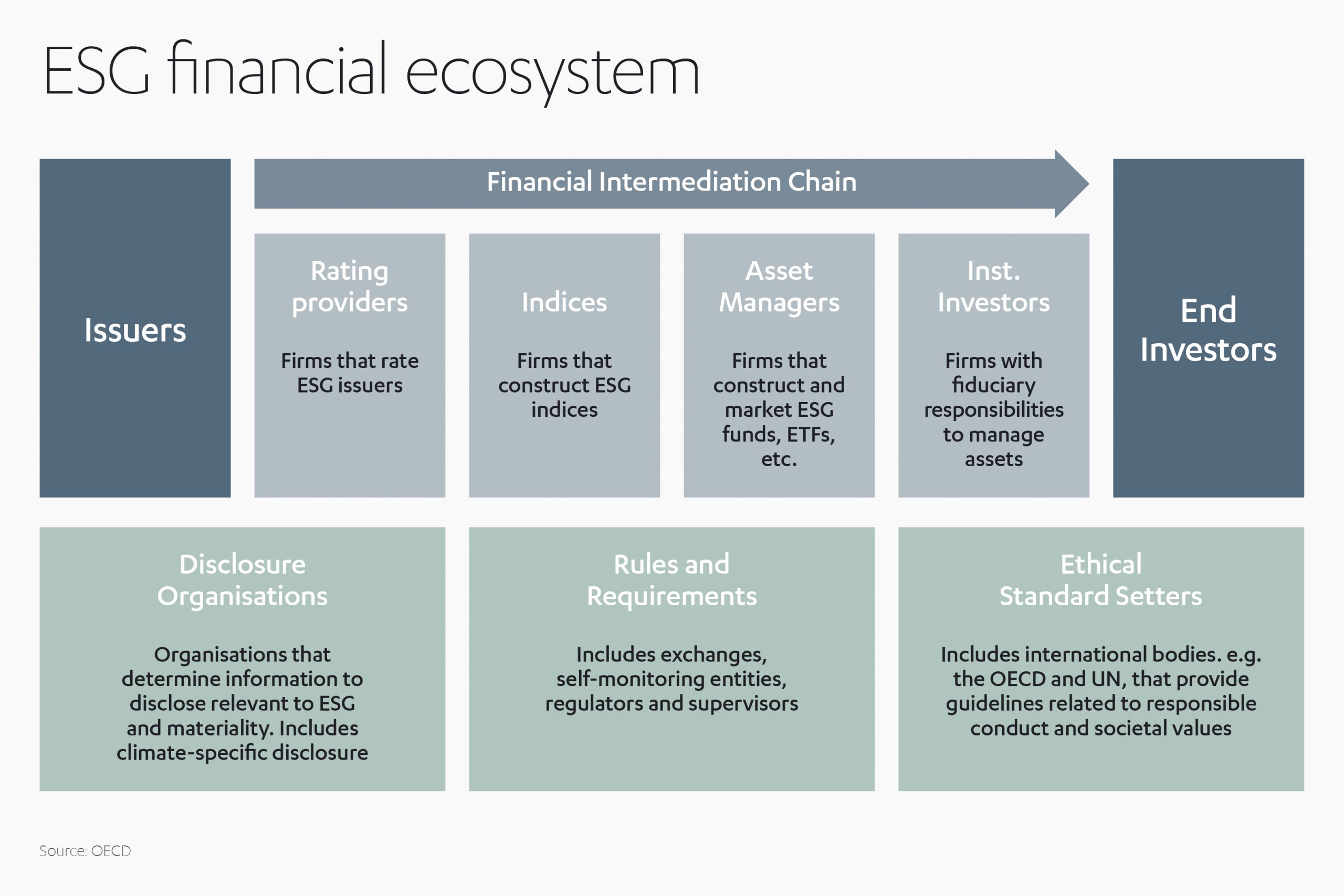

It is in this ethically-rich soil that environmental, social and governance (ESG) investments – in other words, investments that are responsible, sustainable and principled – are set to prosper. Today’s investors increasingly think about their investment decisions differently. They want their money not just to earn something, but to do something.

But is ESG a uniquely modern concept? Arguably, one can trace its roots back to the 1960s and 1970s when conscientious investors channeled the ‘protest spirit’ to shift their financial allegiance from the morally dubious to the socially beneficial. As such, many rerouted monies from industries supporting divisive regimes into projects such as affordable housing and healthcare facilities.

The idea gained further traction in the 1980s when sociologist James S. Coleman argued for ‘social capital’ to become a valid measurement of value – a concept seized upon by contemporary environmental activists.

In the 1990s came the notion of the ‘triple bottom line’, tying social and environmental concerns to the more traditional financial yardstick of success. By the 2000s, the first environmental financial research group was established. This so-called ‘virtuous circle’ comprised City of London bankers, lawyers and NGOs, who demonstrated a link between financial performance and environmental/social standards.

The orthodox view that return on investment (ROI) and philanthropy were incompatible was at last beginning to recede, and in 2011 a list of the hundred best companies to work for published in the Journal of Financial Economics showed stock returns more than 2% better than their rivals.[1]

As awareness and concern around climate change increased rapidly throughout the 2000s, ‘people power’ gave new energy to the once fringe view that business had a function beyond generating profits – and propelled environment-driven ESG up the financial priority agenda.

What we have witnessed over the past few years is an acceleration of that original, pure ideal: can one make money while simultaneously making the world a better place?

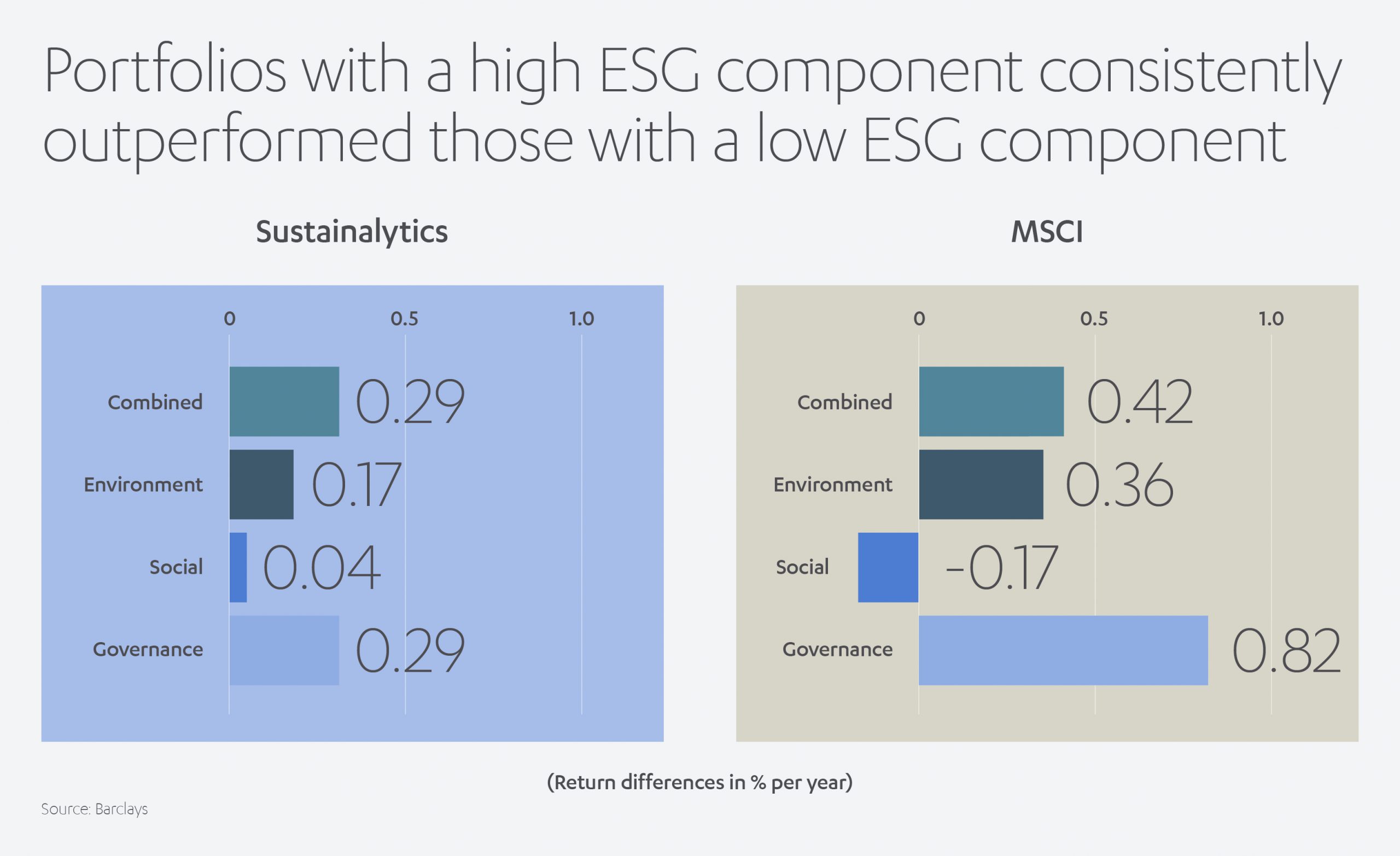

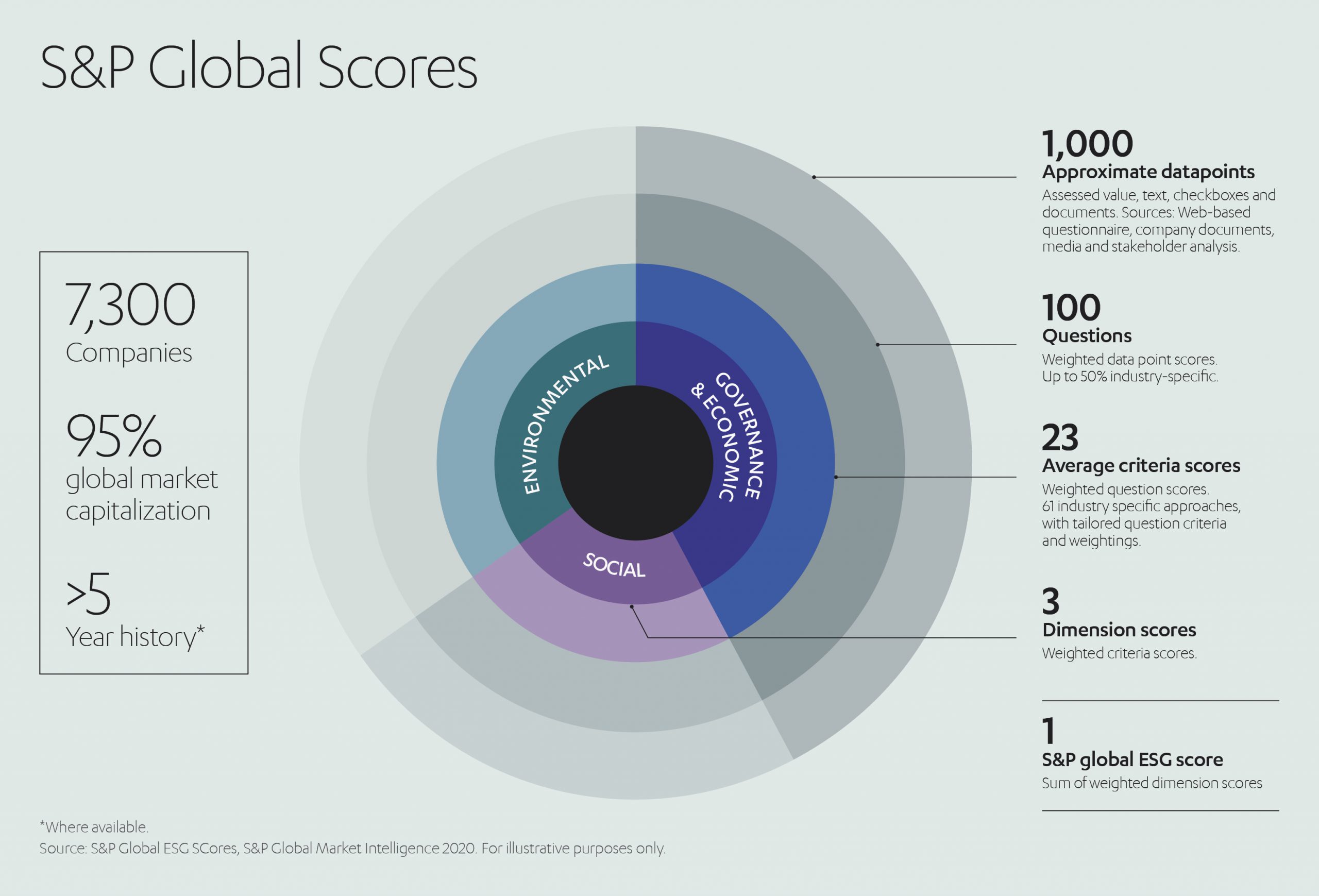

The answer is unequivocally ‘yes’ and the strength of the data reinforces this opinion.

An environment worth trillions

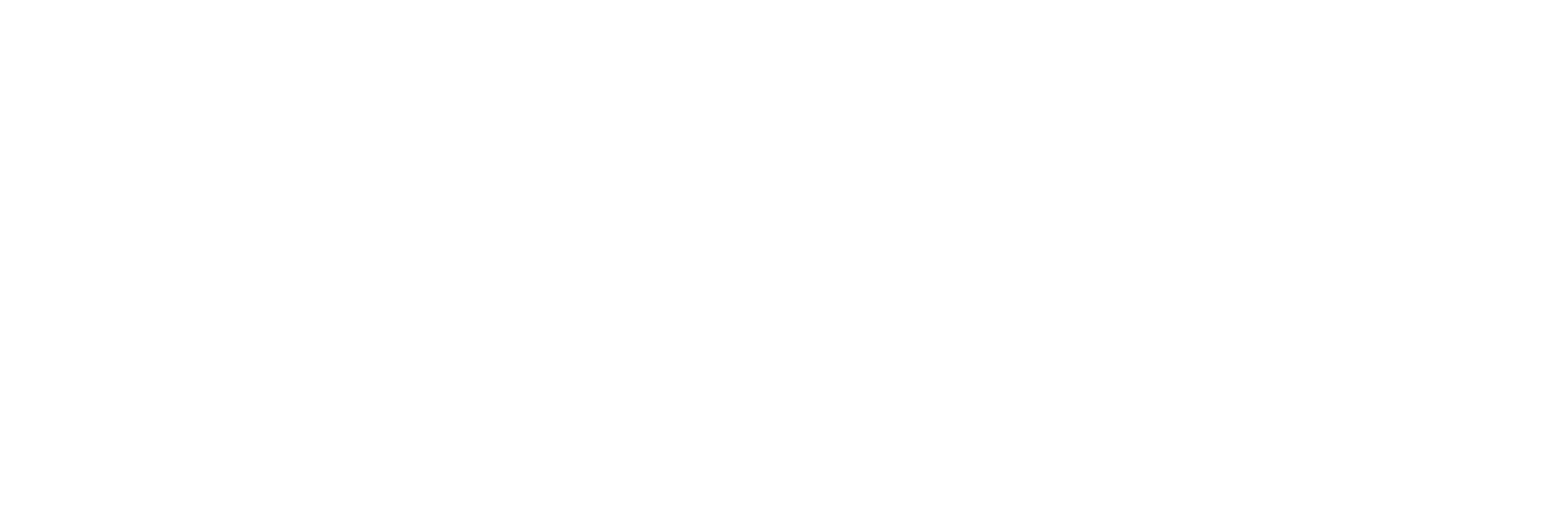

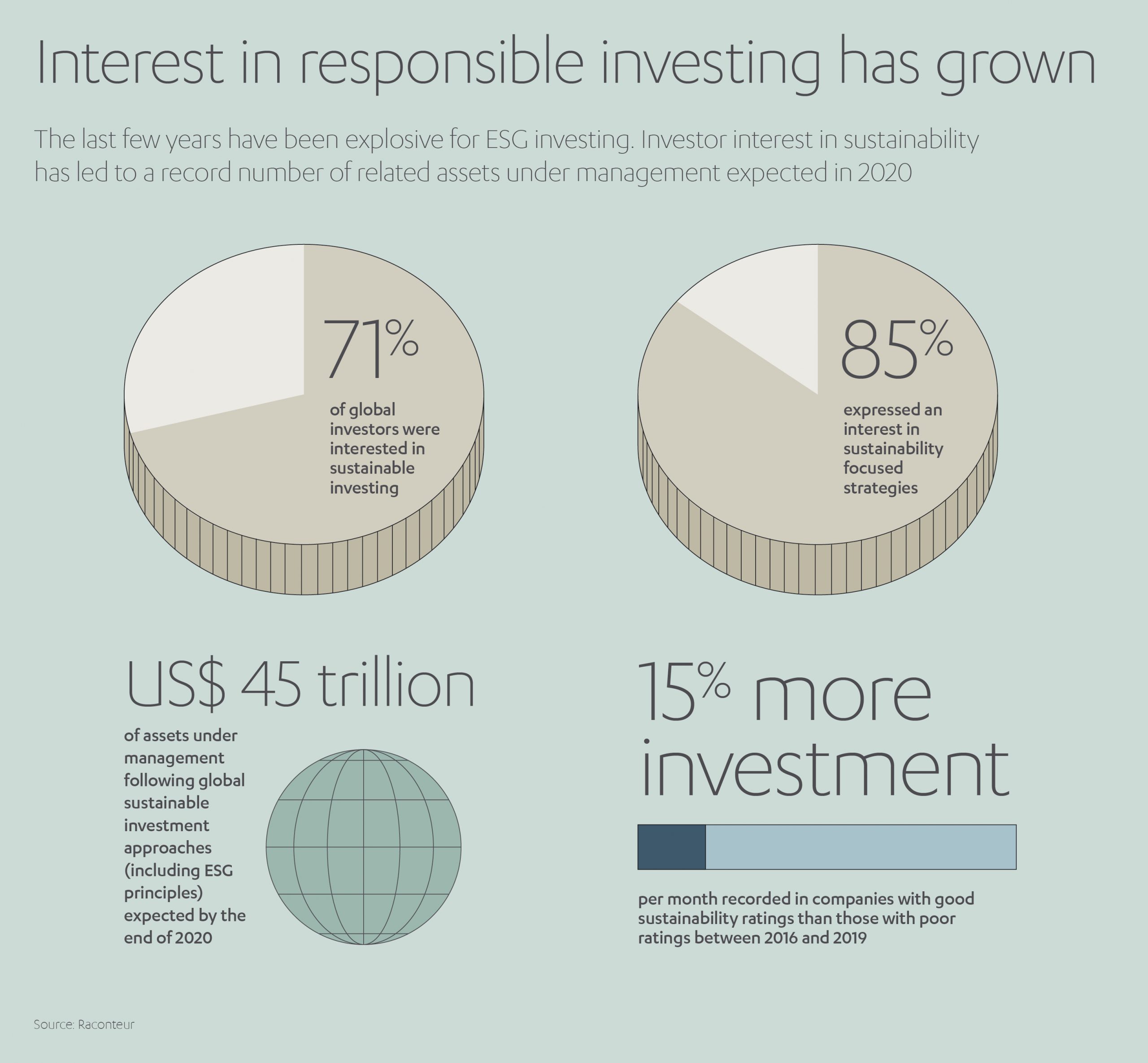

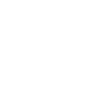

The ascendancy of ESG funding demonstrates how investors are increasingly aligning their goals with hot-button topics such as climate change.

Even in a COVID-blighted 2020, ESG investments have rallied globally, despite widespread market turmoil[2]. Banking colossus Goldman Sachs has taken note, telling clients that “prior to this crisis there was a meaningful and increasing focus on ESG investing and it is likely that this focus will only increase following coronavirus.”[3]

The Financial Times tips ESG funds in Europe to treble in scale between now and 2025, reaching €7.6 trillion over the next five years, accounting for more than half of the European fund sector.[4] It’s big business, and the word is spreading fast.

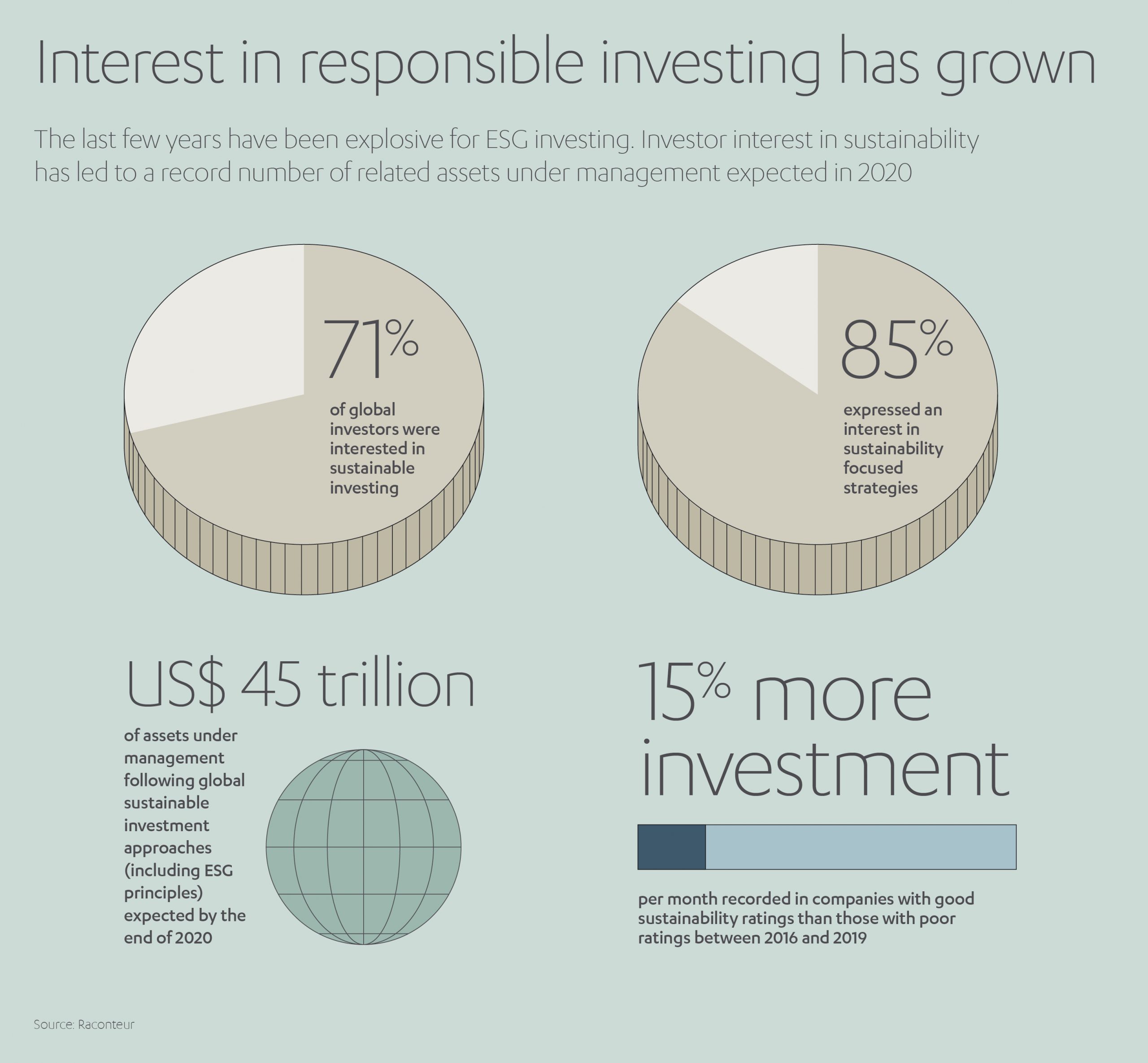

A Morgan Stanley survey showed four out of five asset owners were now factoring ESG considerations into their investment choices[5], while a poll from KPMG revealed more than a third of top company executives were increasing their focus on ESG due to investor concerns.[6]

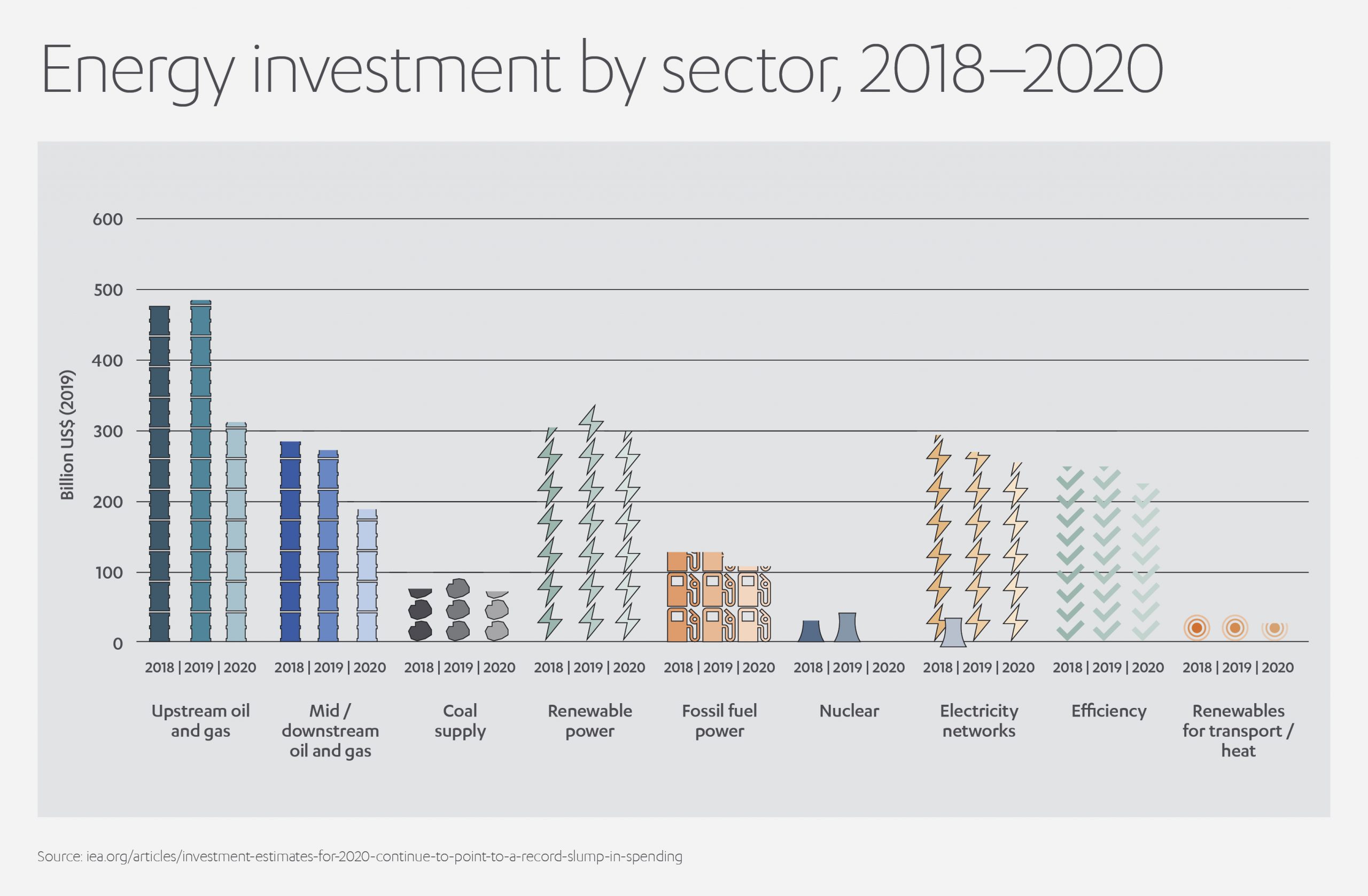

For green investment in particular, ESG is a true game changer.

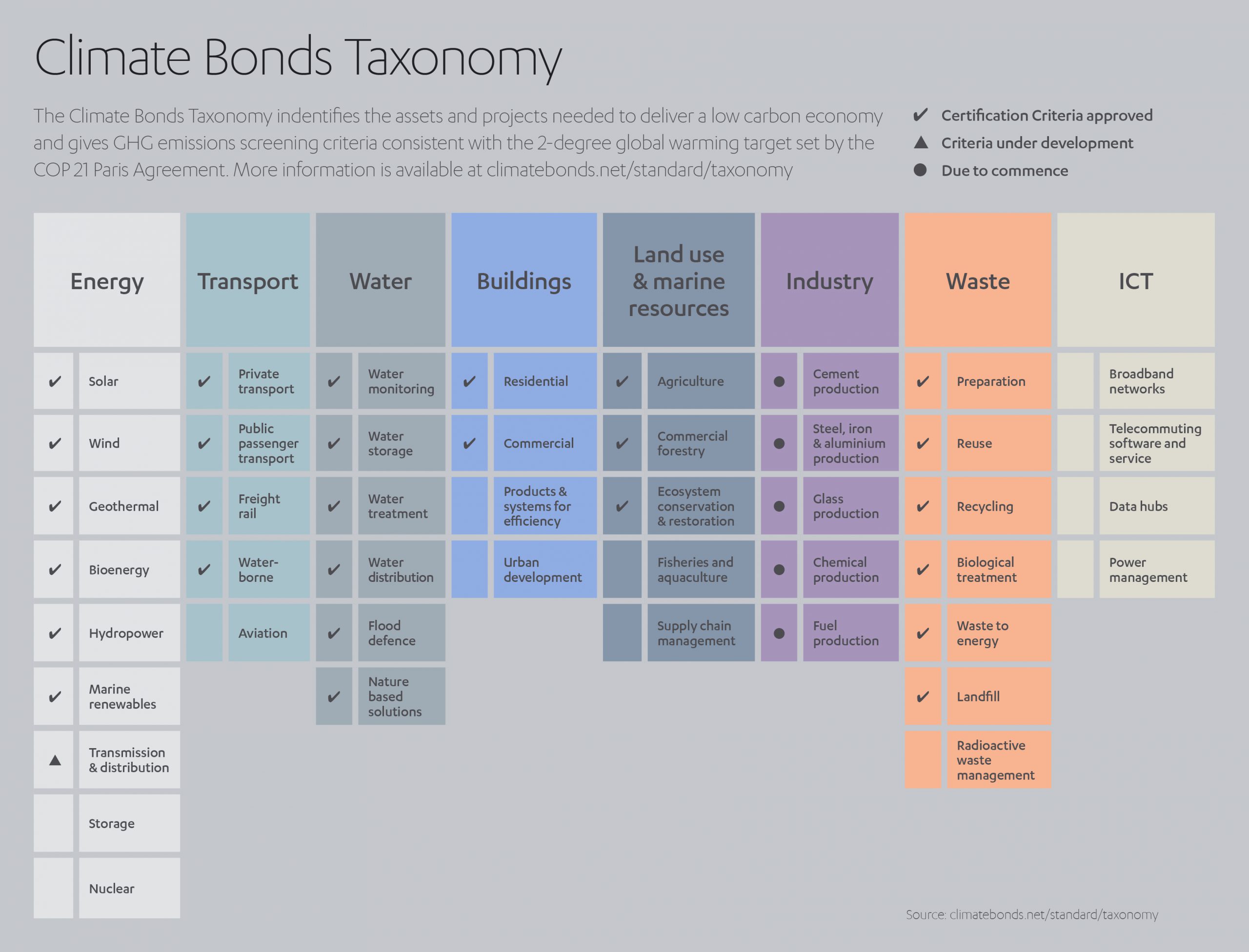

At its most basic level, the rising focus on ESG will compel businesses to be more open about their environmental impact. More importantly however, investment translates into infrastructure, talent and research. Logically, ESG will therefore dictate which businesses are destined to flourish amid a transformative influx of funds.

With technology trumping heavy industry in the eyes of ESG investors, for instance, we can begin to forecast which sectors are primed to soar in the coming decades.

With the world braced for radical climate change (a temperature rise of at least 2.5˚C is predicted for this Century[7]) it is the E in ESG – the Environment – which will likely fuel the ESG investment surge in years ahead. Whether it will save us from our hubris remains unknown. Its impact on the market is more quantifiable.